How America Pays for College

SallieMae is out with their 10th annual report on how Americans pay for college (undergraduates only). Looking back on SallieMae’s data over the past 10 years, three trends emerge:

- Scholarships and grants are covering more of the costs.

- Students are assuming more of the college-paying burden.

- Parents are paying less for college than they did in the past.

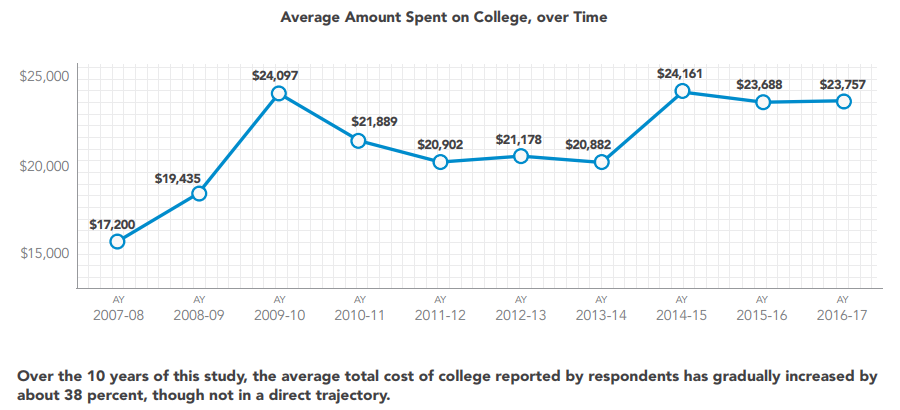

Before unpacking these, let’s look at how the average amount spent on college has changed over the past decade. The figures below represent total cost of attendance — not just tuition, but also room and board, books and fees, and any additional cost-of-living expenses.

We’re paying an average of 38% more for a year’s worth of college since the 2007-2008 academic year (AY). Okay, so where are we getting the money? SallieMae tracks six sources: Scholarships & grants, relatives & friends, student income & savings, parent income & savings, parent borrowing and student borrowing. The portion paid by relatives and friends has been roughly constant. Changes within the other five categories are more interesting.

Scholarships & Grants are Covering More of the Costs

The percentage of the total cost of college covered by scholarships and grants has increased from 25% to 35% in the last decade. This means that while college sticker prices have been rising faster than inflation, it’s not as bad as it sounds. Students have been getting more scholarship and grant money than in prior years.

For instance: The graph above shows that for the 2008-2009 academic year, the average amount spent on college was $19,435. When you consider that 25% was covered by scholarships and grants, families only had to come up with $14,576. Fast forward to the 2016-2017 academic year. The average amount spent on college was $23,757. But since 35% was covered by scholarships and grants, families only had to come up $15,442. Yes, that’s still a lot of money! But it’s only 6% more than it was 8 years prior. That’s less than a 1% increase per year.

Most scholarship money comes from institutional aid — schools themselves finding more ways to be generous in order to fill and shape their incoming classes. Students who stand out academically, athletically or musically at a particular college usually gain the most because schools tend to give out more money to their preferred students.

The greater leveraging of scholarships and grants means families are being savvier with regard to bargain-shopping. Qualification for most scholarships and grants is dependent on filling out the FAFSA — something more families did in 2016 (86%) than in 2008 (74%). Also, back in 2008, only 58% of families eliminated colleges due to cost. In 2016, 69% reported doing so.

For whatever reason, parents are either unable or unwilling to serve as the primary source of funding for college.

Students are Assuming More of the College-Paying Burden

For the 2008-2009 academic year, students covered 24% of their college expenses from their own income, saving or borrowing. More than half of that 24% was borrowing (14%). That’s not surprising, as students tend to have negligible savings and (at most) a modest income. Their parents? In 2008-2009, Mom and Dad covered 45% of their kids’ college costs from their income, saving or borrowing.

Fast forward to 2016-2017: Students paid or borrowed 30% of their total costs, while their parents only covered 31% of those costs. That’s a big change: For whatever reason, parents are either unable or unwilling to serve as the primary source of funding for college. This 30% figure for students is a 10-year high. The 31% figure for parents is a 10-year low. Not surprisingly, 76% of students today work to help cover their expenses.

So are these students making a lot more cash? Not really. Their income and savings contribution in 2016-2017 are the same as they were 3 years ago. Where are they getting the extra money? Their average amount borrowed increased by 50% over these 3 years to an all-time high. Though the growth in student borrowing has been uneven, it’s now at a 10-year high.

Parents are Spending Less for Their Kids’ College

The SallieMae report found that 9 out of 10 parents say they “knew” their child would attend college since he or she was in preschool. But fewer than 4 in 10 families had a plan to pay for college before their child enrolled. And in 2016-2017, only 13% of parents used resources from a 529 plan to cover the expenses of their child’s college — a five-year low. This is somewhat unexpected since the economy today is arguably as good as it’s been in the last five years. The unemployment rate is down, the stock market is way up, and housing values have grown steadily. So what’s going on?

One aspect may be that parents value college for their children, but they’re either not planning or not willing to pay a whole lot to make it happen. For example, the SallieMae report found that fewer families today equate a high sticker price (also known as “cost of attendance”) with a high quality of education. In 2008, 40% of families agreed with the statement “The cost of attendance has no relationship to the quality of the education.” Today, 45% agree.

So parents may be saying, “Hey, we’ll help pay for your college, but we’re not going to break the bank.” The kids may be responding, “Fine, but I really like this more expensive school, so I’ll just borrow a bit more to make up the difference.” That would help explain the all-time high figure for student borrowing, which has allowed overall student contributions (savings, income and borrowing) to almost match what Mom and Dad are covering.

It’s great that families are landing generous scholarship and grant funding, but the pull back on college spending on the part of parents may be shifting a larger debt burden onto students.

Dr. Alex Chediak (Ph.D., U.C. Berkeley) is a professor at California Baptist University and the author of Thriving at College (Tyndale House, 2011), a roadmap for how students can best navigate the challenges of their college years. His latest book is Beating the College Debt Trap. Learn more about him at www.alexchediak.com or follow him on Twitter (@chediak).